如果你是美国居民或身份,在考虑小额个人贷款时,一定不要错过 Personalloans.com,这是一个有19年运作历史的美国贷款公司, 它是获得快速贷款的一种最简单方便的方式,是信誉极佳的贷方网络。

PersonalLoans.com 特点

- 贷款金额:500 至 35,000 美元

- 年利率范围: 5.99% 至 35.99%

- APR 范围:5.99% 至 35.99%

- 偿还贷款期限:3 至 72 个月

- 时间:1个工作日

- 可用性:美国所有 50 个州

PersonalLoans.com 概述

PersonalLoans.com 成立于 2001 年,是致力于提供个人贷款最古老的在线市场之一。该平台不是直接贷方,而是充当借款人与提供各种不同贷款金额、条款和利率的贷款公司之间的中间人。

该平台上的贷款金额多样化:只需 90 天的还款期限即可借入低至 500 美元的资金。这是通过业界最小的贷款金额和最快的还款计划,这也是它在竞争中脱颖而出的原因之一。

Personalloans.com 优点

- 无需最低信用评分

- 短期贷款的理想选择

- 免费使用

- 快速贷款申请流程

- 灵活贷款

Personalloans.com 缺点

- 要求提供大量个人信息

- 只提供小额贷款

PersonalLoans.com 是免费的个人贷款服务平台流程

该平台是免费使用的。优惠灵活,范围从短期到六年的计划,其中一些还款条件是市场上最好的。

这是其官方声称的免费服务原因:

Our service is free, but we may be compensated for sharing your info and marketing non-loan products.

PersonalLoans.com 本身不是贷款方,但是,它拥有自己的大型贷方网络,并与其他可靠的第三方贷方网络合作。

在 PersonalLoans.com 上提交贷款申请表,你的信息会显示给这个庞大的贷款人扩展网络,贷款方可以根据你提供的信息决定是否向你提供贷款,自己无需逐个研究每个贷方,这可以大大节省时间。

在该网站将你与贷方联系后,可能会向你展示贷方和/或其他信用相关产品或服务的广告,例如债务减免、信用修复、信用监控;还可能向你发送有关此类优惠的其他营销信息,他们会从这种额外的营销活动中获得经济利润,这就是为什么此网站提供免费服务的原因。在广告披露中了解更多信息。

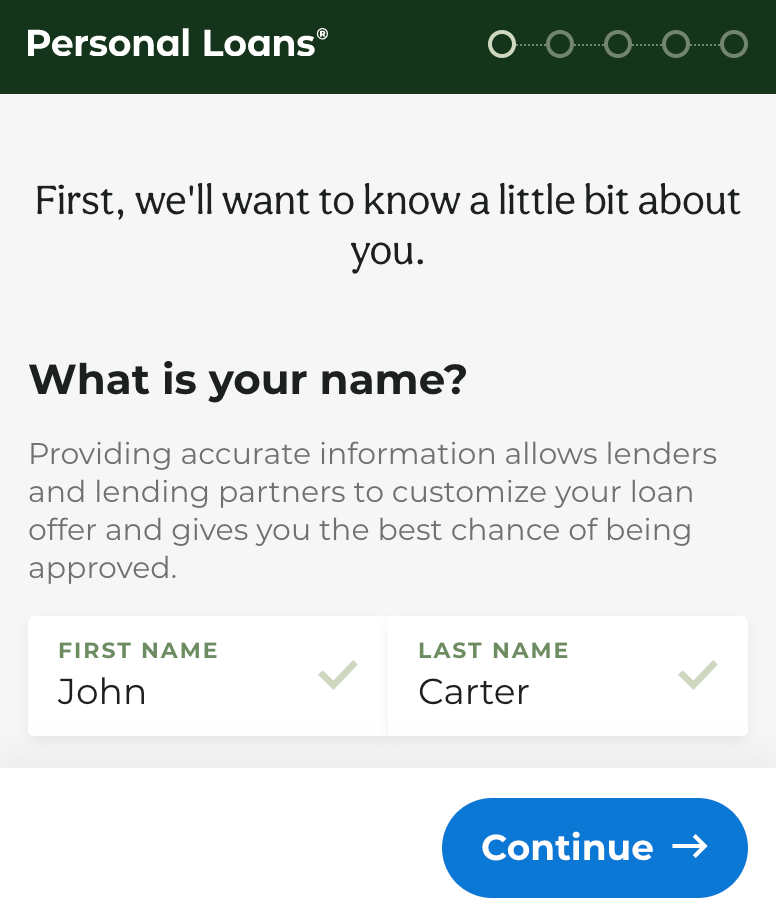

PersonalLoans.com 平台申请个人贷款流程

该网站帮助用户与其网络中贷方和第三方贷方建立联系,而且整个在线贷款过程只需几个简单的步骤:

在其网站上填写简单的贷款申请表:

- 想借多少钱

- 你的信用类型

- 贷款原因。

该表格还将要求提供一些个人、银行和收入信息。此信息将显示给贷方和其他第三方贷方网络中的贷方,以便这些贷方可以选择是否向你提供贷款。

在审查贷款申请信息后,贷方或贷款合作伙伴将根据所提供的信息,邀请你在他们的网站上完成申请,从而决定是否提供贷款。

如果获得批准,将被重定向到包含条款和条件的贷款协议页面,包括需要偿还的金额和还款时间框架。在接受要约之前,请确保了解贷款协议的关键要素,包括贷款利率以及还款条款。

如果同意贷款协议的条款,贷方会将资金直接发送到你的银行账户。资金到达账户所需的确切时间,将取决于贷款批准时间以及贷方或贷款合作伙伴,但一般会在一到五个工作日内收到款项(取决于你的 favorite 和资格)。

这些优惠适用于信用评级较差的申请人和寻求个人贷款以进行债务合并的申请人。大多数 商业贷款 不会向尚未启动和运营的公司提供贷款,但是你却可以从 PersonalLoans 获得资金来开展业务。

PersonalLoans.com 申请条件

在 PersonalLoans.com,可以申请 500 美元到 35,000 美元之间的贷款,通常会在 24 小时内获得批准。

- 申请人必须年满 18 岁。

- 申请人必须是美国公民或永久居民。

- 申请人必须有一个有效的银行账户。

- 申请人必须有适当的收入用于还款计划。

年龄/身份证/居民身份

必须年满 18 岁才有资格获得个人贷款,必须拥有有效的社会安全号码,并且是合法的美国公民或永久居民。

收入

为确保偿还贷款,申请人必须拥有全职工作、自营职业或定期领取残疾或社会保障福利。一些贷方或贷款合作伙伴可能需要工资单或其他形式的收入证明。

一个有效的支票账户

多数贷款需要一个有效的支票账户,因为一旦通过 PersonalLoans.com 批准贷款,贷方或贷款合作伙伴会将资金直接存入你的账户。

信用类型

虽然拥有良好的信用总是更好,但申请人不一定需要拥有良好或优秀的信用记录才能获得个人贷款资格。不过,拥有良好或优秀的信用,贷方可能为申请人提供更优惠的条款。大多数贷方要求客户展示一种责任模式。

要获得个人贷款产品的资格:

- 个人通常不得有任何账户延迟超过 60 天;

- 不得有活跃的或最近的破产;

- 不得表现出延迟付款的模式;

- 不得有任何当前收入无法弥补的债务;

- 并且不得有任何最近注销的帐户。

虽然满足上述要求并不一定保证获得个人贷款的批准,但可以大大提高获得批准的机会。

个人贷款类型

点对点贷款

- 信用评分:600+

- 最低收入:每月 2,000 美元,必须可核实

- 收入来源:受雇或自雇

- 贷款范围:1,000 至 35,000 美元

点对点贷方将借款人直接与投资者联系起来,而不是自己提供贷款。点对点或 P2P 贷款意味着,你将直接从个人或公司而不是银行借钱。点对点贷款确保借款人与希望投资详细说明的个人配对。通常,你的贷款原因会披露给审查 P2P 贷方系统上可用票据的投资者。

作为借款人,你要填写一份基本的贷款申请表及贷款金额。然后,投资者会查看你的列表并选择最适合其特定需求的列表。一旦达成交易,你将每月向投资者支付固定款项,直到贷款还清。

整个过程在网上进行,因此完全可以在家操作。申请贷款只需几分钟,如果你有资格获得点对点贷款,则会获得可供选择的贷款选项列表。由于利率较低,许多借款人更喜欢点对点贷款。

根据你的信用类型,你可以通过点对点贷款借入 1,000 美元到 35,000 美元不等。PersonalLoans 与多家 P2P 贷款贷方合作,每个贷方都有自己的一组投资者和条款。点对点贷方通常会收取 1% 至 5% 的贷款发起费,该费用从提供给借款人的贷款金额中扣除。

个人分期贷款

• 信用评分:580+

• 最低收入:每月 2,000 美元

• 收入来源:受雇、自雇或福利

• 贷款范围:1,000 至 35,000 美元

个人贷款分期贷款流程快捷方便。

你可以通过提供基本的个人和财务信息在线申请贷款,而且,贷方或贷款合作伙伴会根据你的财务需求量身定制的贷款协议。一旦接受贷款协议,贷款将直接存入你的银行账户。

在签署之前查看协议条款,因为每个贷方或贷款合作伙伴都有自己特定的还款流程。

鼓励消费者研究适用的联邦和州法律,并向贷方或贷款合作伙伴询问更多信息。如果贷方或贷款合作伙伴由联邦认可的美洲印第安部落和主权政府全资拥有和经营,则适用的部落和联邦法律管辖其贷款和相关合同、申请和文件。

例如,个人分期贷款可能因州而异。每个州都有自己的个人贷款规则和规定,因此贷款金额和利率将取决于居住的地方。此外,贷款金额、年利率和贷款期限可能取决于贷方或贷款合作伙伴使用的各种因素,包括信用评分和还款历史。

银行个人贷款

- 信用评分:580+

- 最低收入:每月 3,000 美元

- 收入来源:受雇或自雇

- 贷款范围:1,000 至 35,000 美元

银行个人贷款为亲自到当地银行申请贷款的借款人提供一对一的本地服务。

首先,通过电话或亲自提供贷款的个人信息。一些银行甚至允许在线申请贷款。如果在线申请贷款,则会被引导到最近的当地分行亲自完成贷款申请流程。获得批准后,在分行收到资金,或者将资金存入银行账户。

你可能有资格获得最高 35,000 美元的银行个人贷款,可以在当地分行讨论个别条款和付款方式。大多数银行个人贷款都有固定利率,如果获得批准,可能会在一个工作日内得到资金。

PersonalLoans.com 不是贷款人,也不做出任何贷款决定。只有贷方可以决定他们是否选择向您提供信贷或贷款。

personalloans.com 最低信用评分

其他具体要求因您获得的贷款类型而异。例如,对于点对点贷款,至少需要 600 的信用评分和 2,000 美元或更多的可核实收入;个人分期贷款需要580或以上的信用评分。

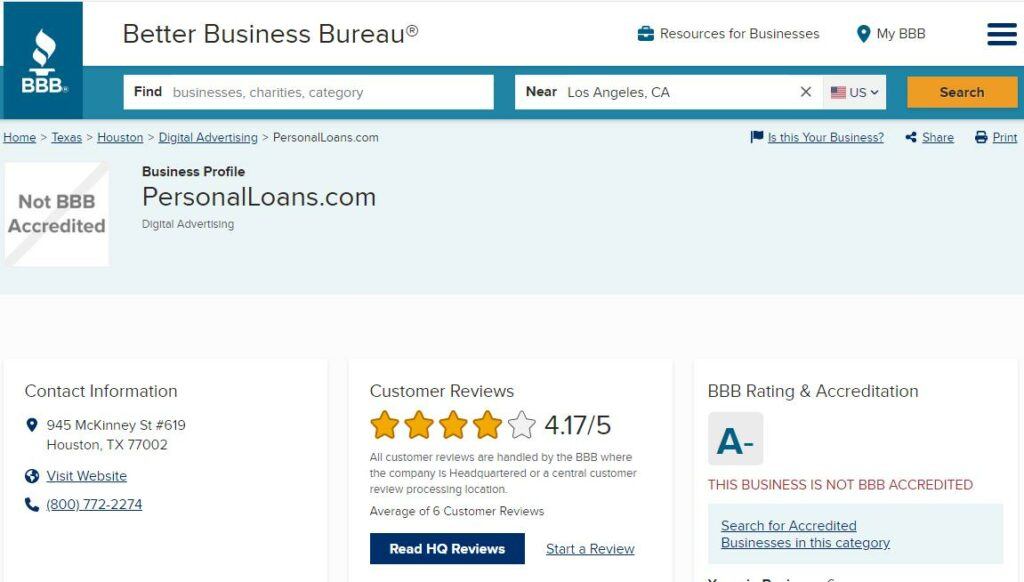

良好的 personalloans.com BBB 评价

虽然 personalloans.com 没有在 美国 BBB 网站进行认证,但是用户对该网站的创建公司-IT Media Solutions, LLC的服务 BBB 评价很好。